Home ownership is an aspiration for the majority and you may a need for some. A dream domestic signifies beauty and you can deluxe. For all of us that require a house to have safety, they helps them to stay safer. Today the houses dream and importance of cover is be easily met, due to the Federal Housing Administration (FHA) and You Agencies out of Farming (USDA), two authorities businesses that make lenders inexpensive. The answer to their property fantasy try FHA lenders and you can USDA mortgage loans. A keen FHA mortgage is actually supported by the new U.S. Agency from Construction and you can Urban Advancement (HUD), which was molded and make homeownership possible for much more members of the united states. The fresh new USDA mortgage was designed to let families buy house into the an outlying form. Each other finance are extremely helpful, yet , involve some secret differences.

1. Down-payment

The biggest matter for a beneficial homebuyer when planning purchase a great domestic courtesy a home loan is the down-payment. Both FHA and you will USDA lenders enjoys relaxed downpayment advantages. FHA financing want an payday loan Babson Park advance payment off a minimum part of the entire cost, while USDA mortgage brokers do not require any down payment.

2. Closing costs

A merchant is needed to happen particular portion of the newest closure costs for both FHA and you may USDA money toward kept amount becoming paid back by client. During the FHA money, the utmost loan amount are including closing costs and should not surpass a defined percentage. While, within the an excellent USDA loan, the newest debtor can get an amount borrowed equal to the fresh new appraised value of our home. The borrowed funds matter you may also use from inside the an excellent USDA financing is actually a whole lot more than simply a keen FHA financing.

step 3. Credit score

Each other FHA and USDA funds was liberal toward fico scores and far more forgiving than simply old-fashioned money. FHA money need a minimum credit rating to be considered. You can even need to pay a minimum downpayment when the they falls on the a particular credit history diversity. The good thing about USDA loans is you don’t have to be concerned about minimal credit history and they focus on people borrower who will reveal that they’re able to spend the money for the newest loan.

4. Urban area Restrictions

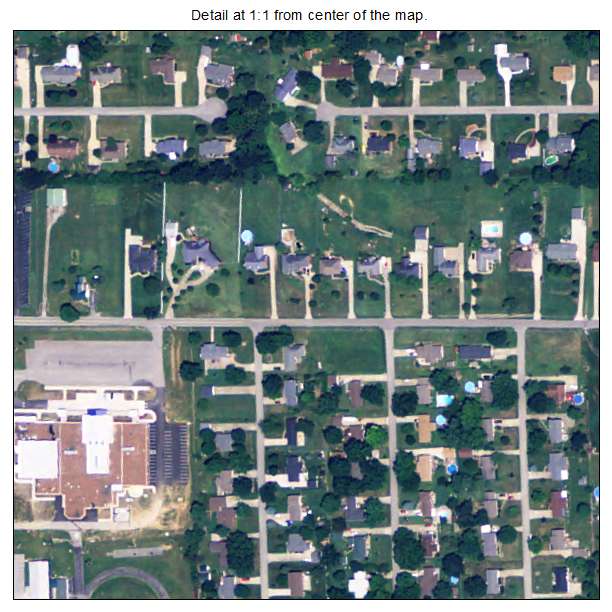

There are no local area limitations for buying a house using FHA financing. It means you can buy a house that is receive anyplace (not restricted to help you a particular town). USDA finance appear only for those individuals qualities which might be located in a location certified just like the rural or partial-metropolitan by the USDA. You may be amazed to find out that in which you get be life style can come significantly less than rural or partial-urban place.

5. Income

In the case of FHA funds, the greater number of money you make, the better the mortgage term. A guy generating highest money means a lesser obligations-to-money proportion. This indicates you are less risk for the mortgage lender. At exactly the same time, the fresh new USDA financing is made for the individuals individuals that do not features a higher money. Which mortgage is concentrated so you’re able to lower so you’re able to middle-money mounts. USDA mortgage loans endeavor to build outlying elements to have household who’ve lower income, in lieu of to add that loan and no advance payment.

If you are looking having a mortgage lender inside the MA to assist your choose the differences between FHA lenders and you will USDA financial fund, then Received Home loan Associates may help! Drew Financial Lovers was an effective Boston home loan company that helps you choose a great real estate loan one to best suits your bank account. Our home loan officers can assist you which have financial software you to definitely bring lowest-rates of interest, low-down money, and faster financing words.