Many consumers fresh to assets auctions assume that they have to be prepared to spend the money for complete buy well worth during the bucks however the prompt-increasing need for auctions form there are many and more investment solutions.

A lot depends on the kind of possessions you would want to get as specific large-road banking companies are unwilling to provide mortgage financing into homes it consider ‘unmortgageable’. That always describes a home that, in current position, isn’t waterproof otherwise has no a home, such as for example.

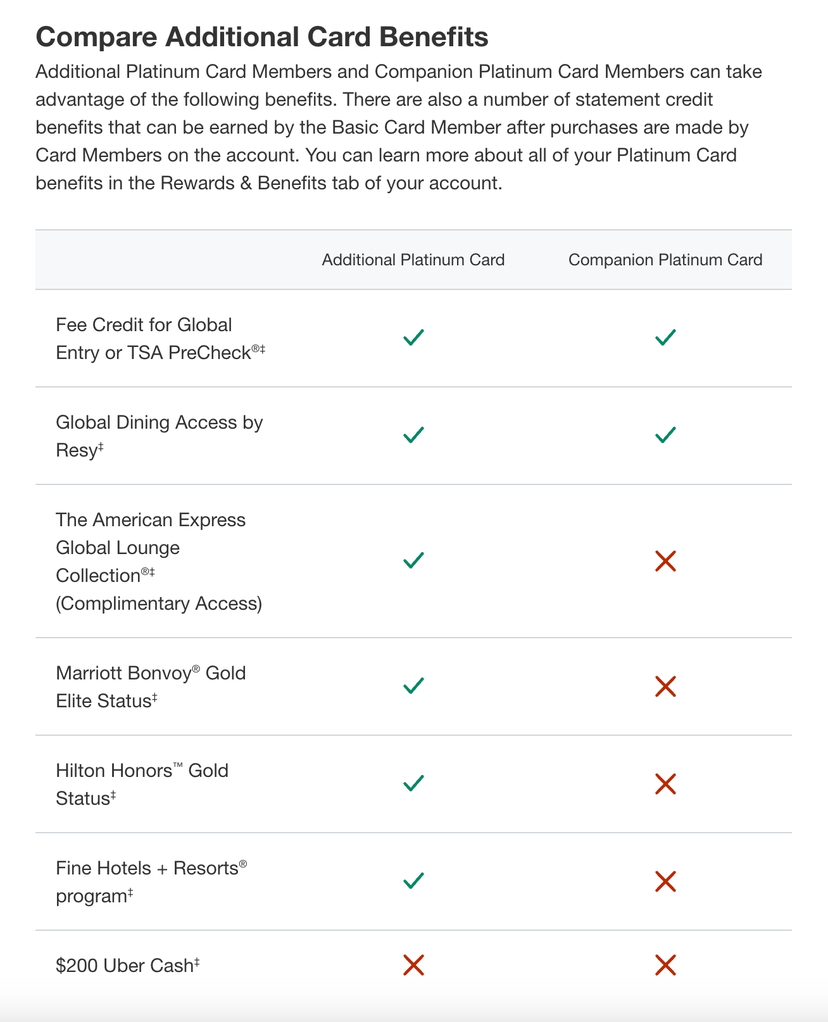

Trick Takeaways

Explore Auction-Certain Financing Choices – Be aware that conventional mortgages may not be right for public auction requests due to time limitations. Instead, thought click resources specialized market funds items like bridging fund, which are designed meet up with the fresh new brief percentage terms required during the deals.

Plan Monetary Independence – Secure an agreement theoretically just before planning a market. That it contract is to cover a roof really worth, so long as you the flexibility to regulate the last loan amount founded on your effective quote, making certain you might meet the auction’s economic requirements.

Confirm Your financial Position – Before the public auction, establish all aspects of one’s capital, together with possible additional will set you back such as stamp responsibility and you may court charges. Ensure that your financial includes these in your financing value if required, and check if your own put resource complies having anti-money laundering laws and regulations.

Carry out Public auction Property Mortgage loans Can be found?

The main reason antique mortgages aren’t well suited in order to auction sales would be the fact these fund may take weeks so you can arrange. Since you likely learn, when you safe property during the public auction, you normally need to pay the latest deposit truth be told there then, to your full balance due inside the about 30 days.

Therefore, deciding on a lender, waiting around for a survey and you may passing compliment of underwriting can take far too much time and wouldn’t provide the investment you should follow into auction business conditions.

Fortunately, discover possibilities, that may is quick-identity financial support, such a connecting loan, and therefore serves like a short-term home loan tool although you program good lower-interest mortgage to repay the bill.

A choice is to believe a public auction fund device built to loans the acquisition out of a home on auction. You’ll find Loan providers who render this type of funds you can find information about that it and other respected loan providers normally utilized by typical public auction attendees inside our earlier book, Tips Loans a market Purchase or from adverts in this our catalogue.

The most suitable choice will depend on your requirements and you may if the possessions you want to bid into the can qualify for typical mortgage capital. Although niche lenders could envision people possessions, most other financial institutions only offer funding to have a great habitable house.

Pro loan providers build choices to your a case-by-situation basis, so they will provide a binding agreement ahead of time of the auction date if they notice that the property gift suggestions a no-brainer otherwise the end value of the new domestic, once modernised, have a tendency to far exceed extent lent.

How come home financing Work at a house Found at Public auction?

Obviously, new complication is the fact deals is actually prompt-paced and often aggressive. Even although you could have an idea about the value the latest auctioneer anticipates to attain and you will what you’re willing to render because the an optimum quote facing an email list, which may every alter at the time.

In place of borrowing from the bank a precise really worth to afford cost of the purchase, quicker the new deposit, you need to have secured credit readily available toward autonomy to modify the total amount borrowed according to the finally winning quote.

The solution would be to strategy a binding agreement theoretically before market. That it arrangement will always include a ceiling worthy of, which is the higher number the lender try happy to offer against for each and every assets you need to quote towards the.