Thus they were financing which were maybe not going to be securitized thanks to Federal national mortgage association, Freddie Mac computer, or through regulators money, Ginnie Mae Securities, which is FHA financing, Virtual assistant financing, and you will USD outlying homes financing

Tim Peterson: A lot of the locations were because, a lot of the big, much more competitive areas, hence was everywhere out-of Washington on front side a number of Tx, the fresh new Denver market, Utah, [crosstalk ]-

Ryan Isaac: Try such merely someone moving? What i’m saying is, all of the urban centers you might be naming is actually towns and cities you to, simply anecdotally, I pay attention to somebody thinking of moving and you can wanting to move to. These are very popular metropolises everyone is types of migrating in order to. Is that they, or is it simply established town population that simply provides [crosstalk ]?

Tim Peterson: It’s each other, along with to consider the latest class of the country as well. I mean, an average period of an initial-go out house client nevertheless in the usa is actually 32 or 33 along the All of us.

Tim Peterson: Yeah, I’m form of in between. You’ve got the Middle-agers, and therefore the society went down. It was not till the Millennial age group so it already been returning up. Therefore we have significantly more first-day home buyers going into the sector, I mean statistically, than before. We got one flood for the last number of years, and it’s really continuous. So there can be only fundamental inhabitants need for construction [inaudible ] across-

Tim Peterson: … away from financial growth which can be going on in many these municipalities and you can MSAs that i only revealed. Therefore there was a beneficial confident consult, that is 100% fortunately. I mean, this is where we are standing on checklist low interest rates. Yes, you will find property enjoy, but the majority of the house designers … There clearly was a survey you to definitely went to home designers, and you will I am merely planning chat where I am right now.

Tim Peterson: 80% of those mentioned that they had zero preparations towards modifying speed to their possessions in this season, that is the loans in Joppa great thing, since the many people are planning, Well, are they browsing remove it? There is some categories in which maybe an expense falls an excellent hair, however, there had been more that being said these people were going to improve pricing of leftover 20% than simply there are however they certainly were probably all the way down they.

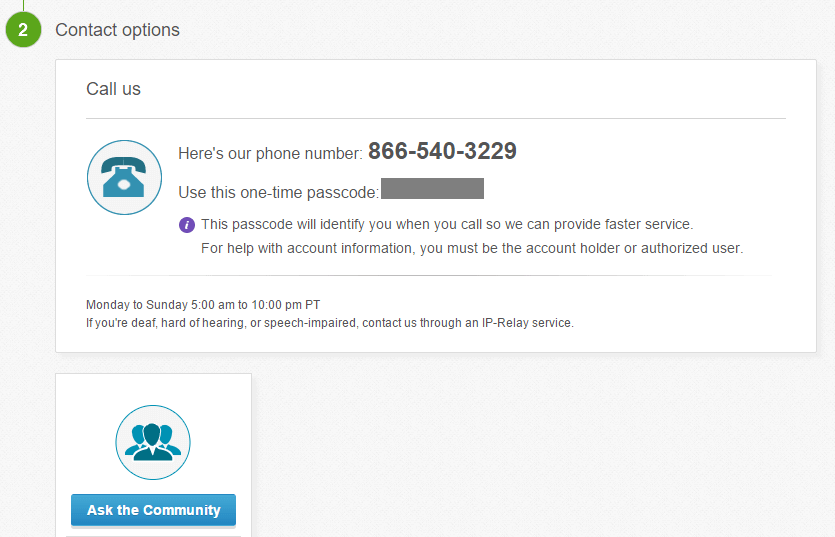

Ryan Isaac: Because you listened to our podcast, maybe there clearly was a concern regarding the money you’ve wished to query. It’s easy to score a response. All you carry out is simply pick-up you to definitely phone, call us in the (833) DDS-Plan to establish a scheduled appointment, or if you should not call us, you can just check out the web site on dentistadvisers, click on the Guide 100 % free Appointment key, and put it up. Its 100 % free. Get it done today.

Ryan Isaac: In advance of, three months before, when all of the COVID posts broke, in which this was all leading, so that you mentioned plenty of self-confident pent-right up demand, really. They’ve been merely awaiting new house and development getting complete.

Possibly they call them low-certified financial or non-QM fund

Ryan Isaac: We want to talk slightly from the pricing, supply of borrowing, how the lending standards provides altered because the ’08?

Tim Peterson: That’s like all one thing. No matter what you might be doing, there’s always thought of notions you to definitely anything have a number of issue which doesn’t, and it is always linked to merely often insufficient knowledge or a lack of elite group help. Therefore all things, working with a specialist is actually very important.

Tim Peterson: You don’t have to end up being the jack-of-all-trades. I am talking about, its why I call you against a financial investment position. It is why somebody phone calls people just like me off a property capital perspective. This really is even relevant for the jumbo markets, as the there was lending restrictions about what you should buy money for Federal national mortgage association and you may Freddie Mac computer.