1. Drew Financial Virtual assistant Funds

Due to the fact a house buyer, you should know of the numerous particular mortgage brokers available additionally the pros and you can advantages of for every single. For those who have offered regarding the army, the newest Veterans Things Home loan, aka new

Va financial

, try that loan system which might be available or their surviving spouse. Which tailored real estate loan program also offers options to generate home ownership simpler to possess You.S. military veterans. Less than, we have detailed precisely what the loan entails and the ways to qualify and you can incorporate.

What is good Va mortgage loan?

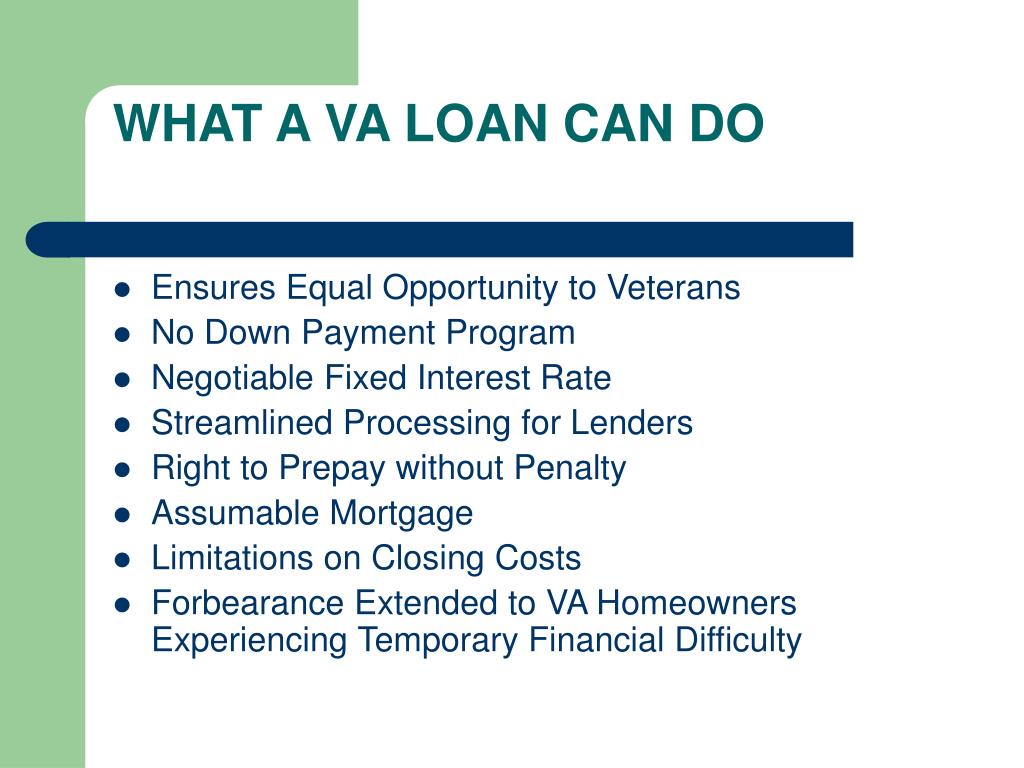

A Va financing is eligible by the You Service out of Veterans Issues. This type of money are specially readily available for those who have served inside the the united states army. This method along with gets to enduring spouses out of pros. The key objective is always to render advantageous assets to pros that make it easier for them to buy a house.

Pros could possibly get enjoy individuals professionals such as for example no down payment, no mortgage insurance, versatile interest rates, prepayment off mortgage loan versus punishment, concession towards the closing costs, with no called for individual insurance policy.

Who’s qualified to receive good Virtual assistant mortgage loan?

- Active-obligations armed forces people, which have at least solution period of ninety days.

- Pros, who’ve maybe https://availableloan.net/personal-loans-or not already been dishonorably discharged.

- Federal Guard/Supplies people.

- Spouses of experts, at the mercy of specific standards into the remarriage.

How to get a hold of good Virtual assistant mortgage financial?

If you’re shopping for that loan for buying your dream domestic, there are many solutions that you could believe. A good Virtual assistant financial is actually yet another loan system readily available for the main benefit of experts of equipped features in addition to their enduring families. An important mission should be to extend assistance to the individuals experts who desire send towards to acquire property.

- Obtain a certificate regarding Eligibility (COE): A certificate off Qualification is necessary because evidence of the reality that that you’ve served the new army consequently they are eligible to sign up for an excellent Virtual assistant Financial.

- Pre-Qualify for The loan Count (optional): Under the prequalification step, you have access to the qualification by contrasting debt reputation against the loan requirements. Prequalification isnt compulsory, although it brings an indicator so you can lenders regarding your credit score, and will promote an advantage more than other consumers who’ve missed this step.

- Shop around to own a house and you may Sign a buy Agreement: After you will be prequalified, you could start together with your household have a look system. Choosing a real estate agent with requisite expertise will make the lifestyle effortless. After you’ve selected a property, you could go ahead further which have examining the home mortgage programs.

Shortly after home bing search is completed, you can get that loan with a signed pick agreement. As a result of its achievement, the latest Va-accepted lender often buy an effective Virtual assistant appraisal. An independent appraiser usually perform the fresh new assessment so you can make sure that loan-to-worth proportion requirements are fulfilled.

Shopping for a mortgage are going to be a monotonous techniques if the done defectively. not, you’ll be surprised to find out that with careful planning, one may describe this procedure . We can make it easier to go shopping for financing that can verify your position are off the beaten track using readily available money. We might be able to assist you with improving your borrowing score, raising the chances of loan certification, and you can choosing the right financing system.

While the a USDA-accepted financial, Received Home loan Couples is excited giving USDA rural mortgage brokers. In the event you be considered, 100% financial support of home ownership at your fingertips. Having interest rates lower than people available with traditional mortgage brokers and flexible guidelines, an effective USDA outlying housing financing may help you achieve your economic specifications. Eligibility to possess a beneficial USDA outlying homes home loan lies in the latest possessions in addition to borrower’s personal items. The house or property need to be situated in an outlying advancement qualified urban area plus it have to be occupied as your primary home. The house loan mortgage officers makes it possible to see whether there was functions towards you you to meet the requirements. Even if you dont consider carefully your city rural, you happen to be shocked to know there might be eligible attributes close. To qualify for a good USDA rural property loan, a borrower need satisfy earnings, borrowing from the bank, and you will work requirements. They want to be also a good Us resident, an excellent You citizen alien, or a qualified non-citizen alien. E mail us today and we’ll make it easier to determine whether you may qualify for USDA investment.