Most of the government mortgage brokers (USDA, FHA, VA) has actually associated fund fees. Even though this initial percentage is called several names anywhere between mortgage software, he or she is essentially the same thing. FHA relates to its percentage since the initial mortgage insurance policies (UFMIP) Va means it because the a money percentage USDA Outlying Housing calls this percentage a good Be certain that Payment

All the USDA financing (get and you will re-finance) need a single-time Make sure Fee that is put into the new borrower’s financing. The current quantity of the fresh USDA make certain percentage try step 1%. Analogy in the event the a borrower was to buy a home 100% funding to have $150,000, the new adjusted amount borrowed into the 1% USDA verify commission could well be $151,500. $step one,500 is set in the base amount borrowed.

Better yet you to definitely-time Make sure Fee, USDA money also require an annual fee that’s placed into this new month-to-month mortgage payment. Fundamentally, the fresh new yearly percentage are monthly mortgage insurance coverage or maybe more commonly known as PMI Once personal loan for self employed professionals more, like the more than, it can have numerous more brands. The present day level of so it commission try .5%.

Example if the a debtor try to get property 100% money for $150,000. $150,000 x .0035= $. $525 ‘s the annual count, now separate that it of the 12 months = $ ‘s the amount of month-to-month financial insurance policies and is additional on borrower’s USDA mortgage.

Bear in mind such charges aren’t the only loan-associated charges or settlement costs having USDA money. USDA mortgage loans (like many money) will also have every customary closing costs that include a florida home loan. Appraisal, Survey, Title, Bodies taxes, bank charges, together with most of the home insurance and income tax supplies getting the escrow account. In general, it is better to work on cuatro% of purchase price is required for all closing costs and you will prepaid supplies. That it profile is also move a few percent, in either case, according to the amount borrowed. High USDA loan wide variety could well be a lot less out-of a share as the a number of the USDA settlement costs ( assessment, questionnaire, etc) is repaired can cost you and do not alter according to the domestic consumer’s purchase price/loan amount.

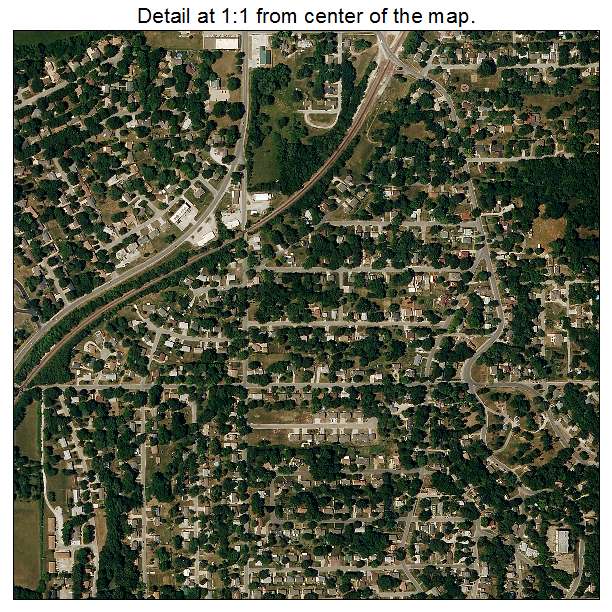

Protected Rural Houses Funds have existed for a time, and also have aided of numerous household and individuals purchase homes in outlying components.

Protected finance can be made into both this new otherwise established residential property that are structurally sound and in good repair. There aren’t any limits toward size otherwise design of the house financed, however it can’t be regularly earn money. The latest financing could be used to get or re-finance a residence.

Less than i’ve indexed the present day USDA mortgage charges to have 2018

In the event the appraised worthy of exceeds the sales rate, you can finance settlement costs and prepaid costs for the for the loan amount. Providers are allowed to expend the newest buyer’s settlement costs too.

The fresh consumers need to entertain our home as his or her number one house. The earnings should not go beyond the fresh new modest income limits based of the the condition.

There can be an automated income eligibility calculator towards the USDA Online web site at this site gives facts about eligible possessions locations once the better.

In order to qualify for this method, borrowers must have a good credit score and you can proven earnings. They must be You.S. people or permanent resident aliens. Secured outlying houses financing wanted your household payment, along with dominant, interest, taxation, and you may insurance coverage, shouldn’t exceed 29 percent of the borrower’s gross income. The complete debts, such as the new house payment divided because of the borrower’s revenues, should not meet or exceed 41 per cent.

Additional factors to get over higher rates could be the end off homebuyer knowledge kinds or future income off a spouse and other co-borrower which basically worked and that is looking to a position.

The application does not require one to individuals be very first-go out home buyers, nonetheless they will most likely not very own a home within this commuting length away from your house being bought. Individuals have to be unable to receive a home loan under other apps requiring a downpayment. The fresh new fund including are built to re-finance either present USDA Rural Creativity Secured Construction or their Point 502 Direct houses money.

Specific exceptions to your being qualified rates may be designed to consumers with high credit scores, a reputation offers otherwise comparable current construction bills

The latest house becoming funded through this system should have accessibility from a road, road or driveway, and all avenue and roads have to be in public places maintained on a hard surface. New belongings can not be subdivided.