Article Assistance

It requires over forty days to close to the an effective family, depending on individuals products, including your overall financial predicament and you will whether you are spending which have cash or resource which have a mortgage. Though the closure processes is fascinating – it means you will get nearer to homeownership – it’s also daunting. With a very clear knowledge of the new schedule helps you eradicate be concerned and then make they towards the closing table with confidence.

Domestic closing timeline

The amount of time it requires to close off towards a property hinges on your percentage method (dollars otherwise financial) and you can loan type of. Purchasing having cash constantly expedites brand new closure procedure as it takes away the necessity for mortgage approval and you can related documentation.

The table below stops working the common closing timelines a variety of home mortgage items – conventional fund, FHA financing and you will Va money.

As you can plainly see, the newest timelines was equivalent along the around three loan models. So you’re able to automate the new closing techniques, maintain open interaction along with your realtor, lender or any other events involved in the purchase. It is essential to function on time so you’re able to asks for more information in order to prevent closure waits.

This new closing process: What to anticipate

Closure on the a house does take time because there are a handful of important procedures inside, that for each simply take from 1 day to a lot of weeks.

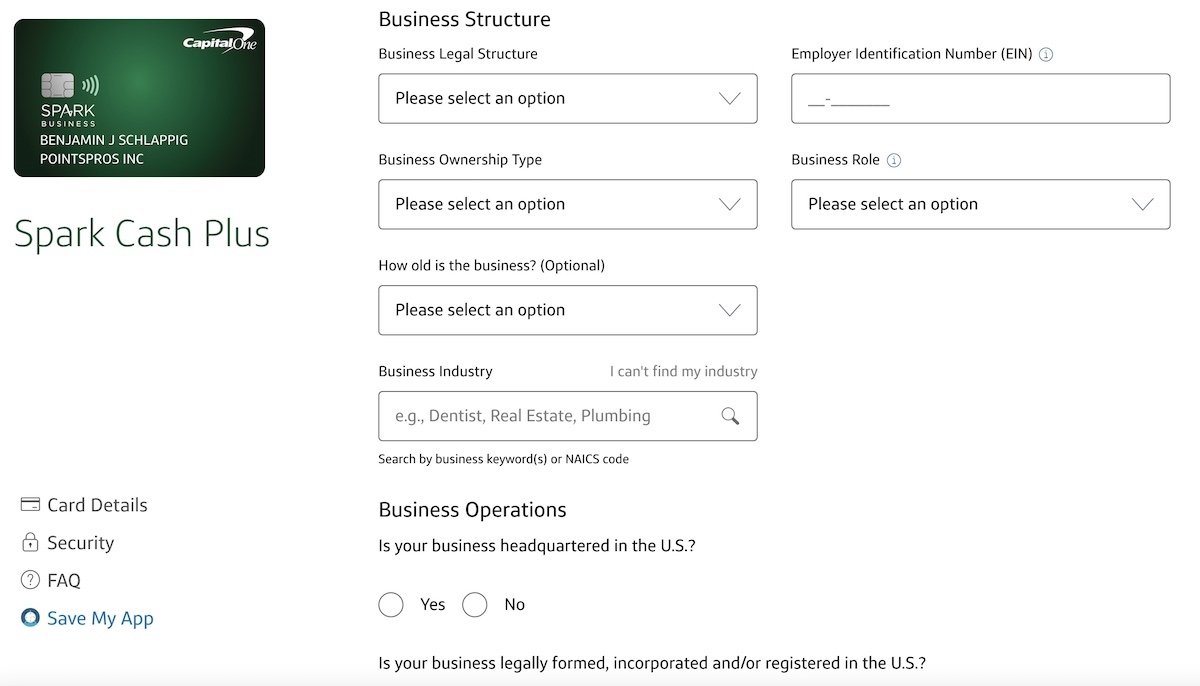

- Home mortgage application: One of the first stages in this new closure procedure is to try to fill in home financing software when you’re taking right out a beneficial mortgage. You’ll need to promote your own Personal Coverage count, target, a career suggestions and you will information about the house we would like to pick.

- Buy contract: A purchase agreement traces the brand new conditions and terms off a genuine property bargain in fact it is usually finalized given that client and you may supplier agree with a purchase price.

- Closure revelation: Lenders must provide a closing revelation, that contains a post on the loan words and you will closing costs, three working days just before your own closure date. It is better evaluate all the info in your disclosure along with your mortgage imagine and have inquiries if you notice inaccuracies.

- House assessment: An examination is vital to greatly help identify difficulties with the home. In the event the assessment reveals something wrong to the household, you could negotiate fixes towards merchant.

- Home appraisal: An appraisal decides this new house’s well worth considering its area, square footage and you can full condition. Loan providers normally wanted a house appraisal to be sure they will not provide additional money compared to the residence is value.

- Underwriting: Whether to find property otherwise refinancing, you’ll want to experience an enthusiastic underwriting way to prove your own qualifications for a financial loan. The timeline to possess underwriting utilizes this new lender’s process and also the difficulty of your own finances.

- Identity lookup: A bona fide house lawyer generally speaking performs a title search inside closing technique to establish there are no liens, unpaid assets taxation or judge conflicts associated with the home.

- Acceptance to close: When you found acceptance to close – you’re nearly from the finishing line. You ought to would a final go-using before closing to verify everything is sure-enough and that the seller complete any called for fixes.

What goes on with the closure big date?

Closure go out comes to an abundance of paperwork and you can signatures. You will need to carefully review new files and inquire any questions you have prior to signing. Closing documents are priced between:

> Closure revelation > Mortgage otherwise action of trust > Escrow declaration > Mortgage mention > Deed > Bikers > Identity insurance policies > Directly to cancel (when the refinancing)

Closing costs are expenses that must definitely be paid back to do a a residential property exchange. You can easily usually have to pay settlement costs for the name providers otherwise closure broker with a certified evaluate otherwise cord transfer – personal checks usually are maybe not accepted. Closing costs range from:

> Downpayment > Mortgage origination and you can software fees > Credit report charge > Prepaid taxation > Financial affairs > Assessment charge > Term insurance coverage > Homeowners insurance > Household inspection > Real estate agent earnings > A residential property lawyer charge

After you have signed the brand new closing documents and paid the brand new settlement costs, it is possible to always discovered your tactics an identical big date. Done well – you’re theoretically a homeowner!