Comment: Recommended lien condition requirement often push of several Title We lenders away from company. One or two commenters wrote that lots of Term We funds consume a third lien position. Ergo, the newest advised requirements manage avoid loan providers out of providing Term I fund, and you can drive lenders bankrupt.

This type of commenters were worried that imposition of one’s more mark conditions tends to make these short money notably less popular with loan providers

HUD Impulse. The necessity is needed to to make certain the brand new financial ethics and continuing stability of your system. Since talked about above, HUD keeps changed brand new lien reputation standards to match particular products out-of a residential property financial support. HUD believes that modified requirements smack the compatible harmony between the necessity for self-reliance, and making certain that the application form operates for the a sound fiscal trend.

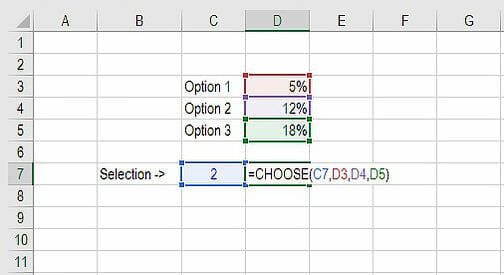

The finish (hence means the fresh new requirements to have mortgage disbursement) to modify the brand new disbursement procedures for lead property improve finance for the excess of $7,500. HUD advised to need one for example disbursements be manufactured playing with a great draw system, exactly like that used when you look at the structure financing. Lenders would-have-been necessary to deposit the mortgage proceeds during the a destination affect escrow membership until he’s paid. Brand new pulls would-have-been made in accordance having standards situated because of the Assistant. The borrowed funds continues would have been disbursed in the three pulls-a first disbursement away from forty per cent of your own loan continues, a subsequent forty % disbursement, and a final 20 percent disbursement.

Comment: Arguments to help you recommended draw system. Numerous commenters typed opposed to this new suggested draw program. The latest arguments raised by commenters ranged, however, all of the agreed that the finally rule ought not to have to have the use of draw disbursement measures. Eg, several commenters had written that proposed mark program will be costly and hard to manage for these Title We money used to make simple home improvements that are completed in a few days otherwise days (including the replacement for out-of exterior otherwise roofing system, installing brand new windows, or the insulation of the home). You to commenter had written that the advised mark program create manage good tall risk of lawsuits for lenders and you will/otherwise property authorities becoming the fresh new lender’s rehab broker. Several commenters wrote the use of pulls is a lot of as called for checks commonly serve to deal with HUD’s stated aim of stopping ventures towards punishment out-of loans. One to commenter requested if the advised pulls program you will argument having State standards governing using draw disbursements about structure world.

Other commenters published the maximum $twenty-five,000 Title I mortgage was a somewhat quick mortgage because of the banking community requirements

HUD Impulse. Up on reconsideration, HUD enjoys did not have to have the accessibility a draw disbursement program to have direct assets improvement loans over $7,five-hundred. HUD will abide by the latest commenters your the means to access instance a good program you are going to expose administrative difficulties getting loan providers and you can . HUD enjoys concluded that the new implementation of a suck program demands next opinion, plus if reduced difficult choice exists to protect contrary to the misuse out of loans. Should HUD decide at a later date to make usage of a blow disbursement program, it will do so as a result of a recommended rule and gives the fresh personal which have a supplementary chance to review.

Comment: Recommended posts or solutions so you can recommended mark system. To deal with a number of the inquiries described a lot more than, numerous commenters ideal adjustment or choice on suggested draw system. For ( print webpage payday loans Howard reviews 56413) example, certain commenters typed you to brings is always to only apply at larger ideas of head finance more than $fifteen,000 (or some other specified number). Other commenters advocated one to HUD modify this new proposed rule to incorporate loan providers and you can borrowers that have better self-reliance in the determining the new appropriateness from playing with a suck program, plus setting-up what amount of expected draws. A few commenters published you to definitely, as opposed to numerous draws, the last code should want an initial holdback regarding ten percent of your loan amount. You to definitely commenter typed that issuance regarding three combined monitors create get to the exact same abilities given that suggested draw system, that have notably less costs on the citizen.