Latest Financial Prices in the Dallas Good food, top-notch sporting events and you can entertainment, museums, outdoor issues, a vibrant sounds scene, and you may higher level environment all create Dallas, Colorado, just the right location to inhabit. Additionally, Featuring its appealing vibe and you may commerce-amicable cost savings, lots of people disperse here from around the country. First-date consumers and you may current residents need to have every pointers regarding the current home loan costs Dallas.

Which have eg popular and you may battle, a potential customer generally matters towards a beneficial mortgage company getting money. By continuing to keep up to date with the alterations regarding the capital opportunities, you may be better provided to research the options for choosing property within this wonderful town.

Mortgage Rates Manner During the Dallas

Based on Norada, a new milestone try attained from inside the in the event the median family price in Dallas achieved $400,000, a growth around 23% during the last season. Scientists claim that new due to a hefty disparity anywhere between also have and you may consult. Due to rising battle for offered property, home prices have been constantly under some pressure.

Financial rates was basically fluctuating over the past day. Freddie Mac accounts that the mediocre 30-12 months fixed interest rate improved once more towards July fourteen so you’re able to 5.51%. An average mortgage costs was 5.30% to the July eight.

Subsequent, the average 29-year fixed rates increased by the 2.48% out of , signaling a strong surge during the mortgage pricing. Just like the Government Set-aside elevated brief-title costs for the June to combat inflation, Dallas home loan rates enjoys proceeded to move higher. Soon after the fresh new Fed’s flow, home loan interest rates saw their most significant times-over-month raise because 1987 as pricing ran right up by the 0.55%.

Also the internal economic uncertainties, the war anywhere between Russia and you can Ukraine, and you may potential the fresh Covid-19 regulations have increased difficulties which could slow down new savings. The brand new Federal Reserve is expected to increase brand new brief-label cost once again from the its July 27th board fulfilling. The new Government Reserve’s aggressive price walk plan throughout 2022 implies that home loan rates continues to increase. As mortgage rates are incredibly erratic in newest socio-economic climates, it is highly told to keep told of all the changes one to take place in the market industry.

Newest Home loan Rates For the Dallas, Tx

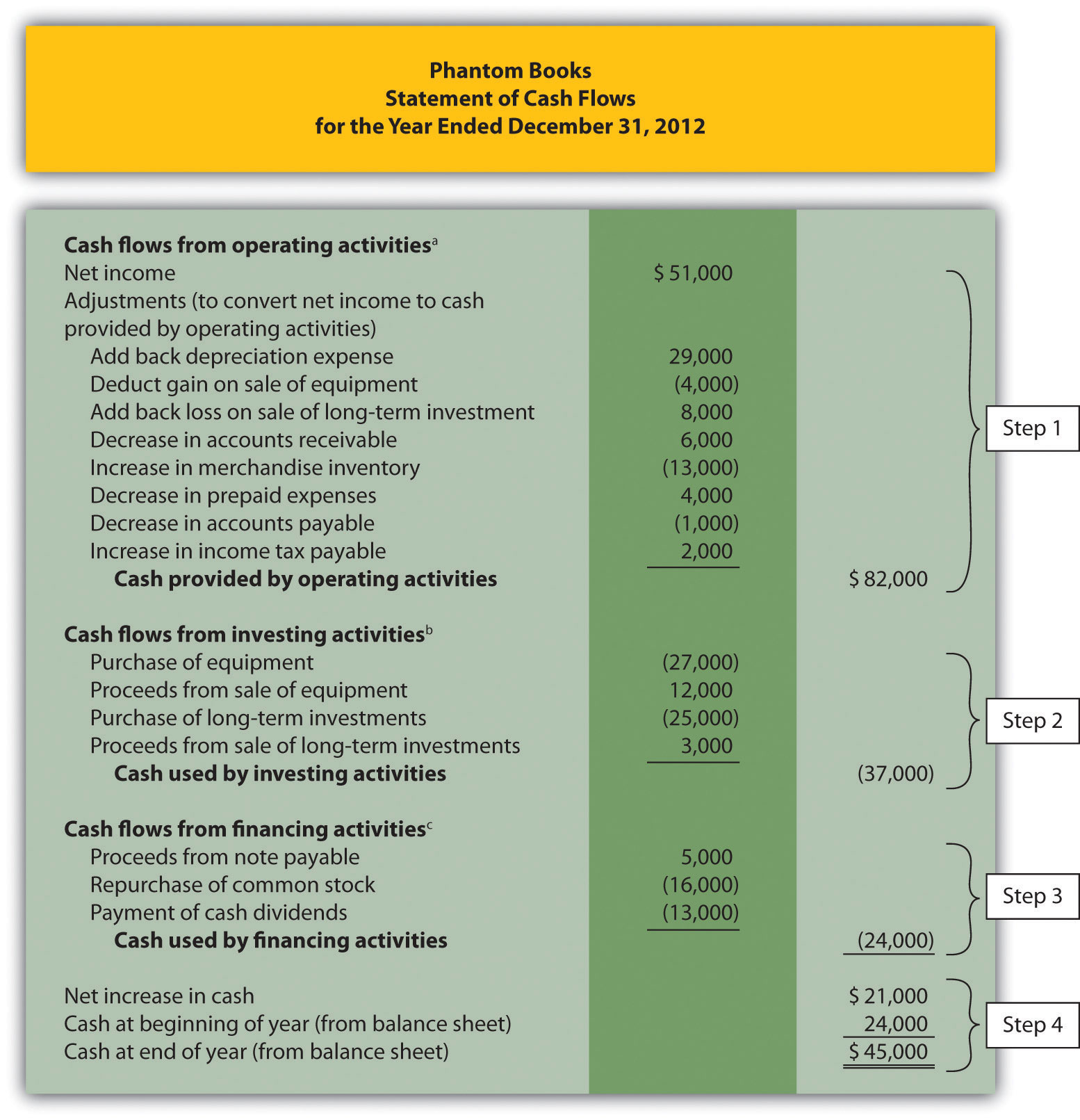

By July 22nd prices to have standard 31-season repaired-price mortgage loans for the Texas fell to help you 5.11%. This info is actually considering Zillow. New desk below reveals the current home loan pricing into the some other financing systems in the Dallas, Colorado. This type of costs can change on the months in the future, especially in light of your Government Set aside fulfilling this week.

You can try for the brand new time of your house pick by keeping up with the most up-to-date pricing. Our goal is to coach you on the specific financial prices from inside the Dallas, Tx in order to a very concentrated search.

To purchase A home Predicated on Manner And you can Financial Cost Into the Dallas

The latest housing market into the Dallas is very scorching today. Tx Realtors accounts that over the final times, houses need achieved a most-time highest, functions were getting numerous now offers, and home was on the market to have alot more versus inquiring price. That said, what number of postings is also increasing. Tx Home Look Center reports the level of productive posts when you look at the Dallas increased by the % if you find yourself the latest posts improved from the %.

Precisely what does this suggest especially for you? Family instructions today will cost you to $800 significantly more in month-to-month expenditures than simply it performed at the beginning of the season. Nearly 20% from potential home purchasers not any longer have the needed income so you can qualify for a house at the latest median speed. Homeowners exactly who recently ordered their homes payday loan Black Hawk are already looking an effective re-finance opportunity to save money.