USDA loans you should never have an important minimal credit score, but loan providers offering this type of money usually wanted a credit rating out-of 640. Credit scores lower than 640 are felt when the there are many acceptable borrowing from the bank uses that are not regarding borrower’s credit rating but can be noted as being reduced once the decided.

USDA talks of outlying areas amply

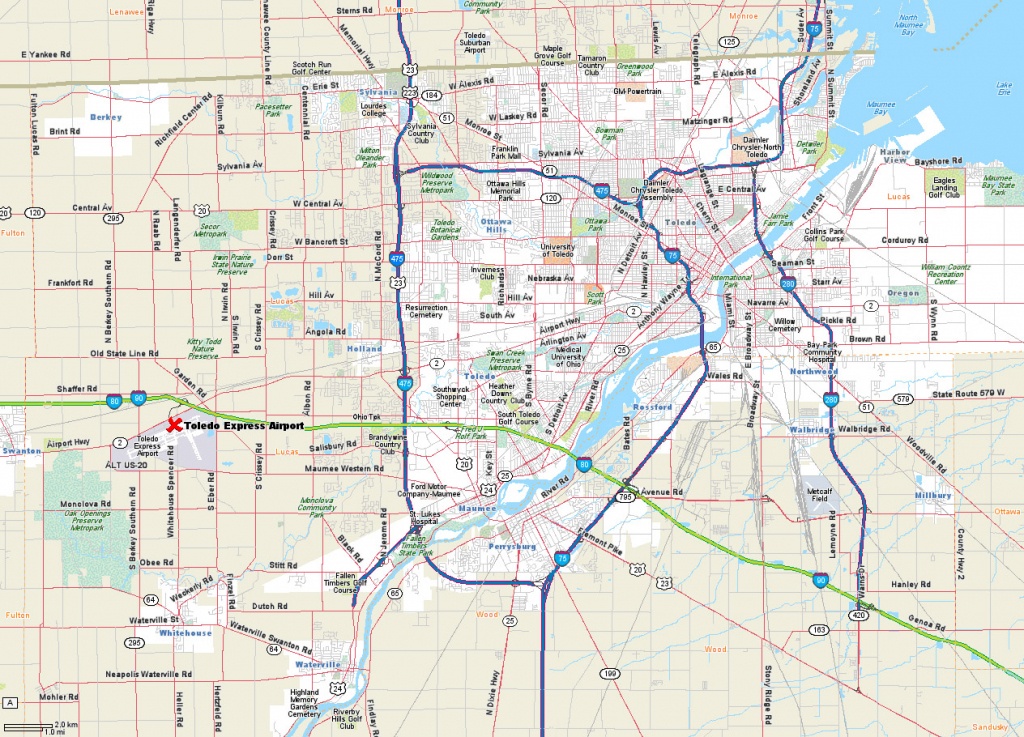

What’s outlying? You would certainly be amazed. New USDA talks of “rural” generously — you don’t have to pick a property from the farm strip to help you qualify. In fact, a good many this new residential property urban area throughout the You.S. drops contained in this definition of outlying. New outlying designation boasts of a lot small- to help you typical-measurements of locations together with residential district portion exterior big locations. The new USDA even offers a beneficial USDA property qualifications search unit to determine certain property’s qualification.

But not, without having a certain possessions in your mind, but instead wish inside the a location otherwise region having a good new house, brand new device makes you zoom in the towards a place from the using the search button on the mouse, so you can see breaking up lines ranging from eligible and you can low-eligible urban area.

If for example the assets we need to buy try an one qualified outlying city, it does be susceptible to limitation mortgage limits for this area.

First USDA Household Guidance and needs

So you’re able to be eligible for such loan programs, the home need to be smaller sizes, structure and cost. Smaller casing will depend on what is actually regular having property in the the space and generally will not meet or exceed dos,000 sq ft more than degrees; its market value dont exceed this new appropriate urban area financing restrict, and it also can’t become buildings principally utilized for earnings-producing aim.

Up-to-date property assistance observe that a preexisting home with an in-ground swimming pool is noticed small; not, in-surface swimming pools which have the brand new build otherwise which have properties that are ordered the new is actually prohibited. Prior to now, current home within-floor swimming pools were ineligible.

House built, ordered otherwise rehabilitated need certainly to meet the national design strengthening code adopted by the condition and you may thermal and you can web site requirements set by USDA’s Casing and you can People Place Applications (HCFP). Are manufactured housing otherwise cellular property have to be forever installed and should meet up with the Service of Houses and Urban Development’s Were created Household Design and you can Coverage Conditions as well as HCFP’s thermal and you may webpages standards.

USDA Secured Loan program payday loans online Utah review

The new Secured Loan system are financed courtesy USDA-acknowledged mortgage lenders and you may brokers. Including the FHA system, brand new USDA doesn’t in person funds this type of money alone but instead claims them, which makes them a safer investment into the lenders. These types of finance incorporate zero subsidies — the thing is that an educated deal you could out of a lending company and pay the heading speed.

Brand new Secured Financing system assistance make it applicants secure doing 115 percent of the median income (AMI) towards area after particular changes. An effective mortgage administrator who focuses primarily on USDA or any other government mortgage loans should be able to make it easier to know if your be considered.

You can also perform a living self-assessment by using the USDA qualifications product; Weight the fresh webpage, to get and click to your “Single Friends Houses Guaranteed”, after that click on “Earnings Qualifications” and choose a state and state and you will submit this new fields as needed.

- The latest USDA GLP guarantees lenders as a consequence of private loan providers towards the purchase of modest houses during the appointed rural section.

- Money qualification is up to 115 % from town median income for the very same size family.

- No downpayment needs.

- Finance is fixed-rate mortgages with 30 seasons terms and conditions.

- Loans are used for solutions also to protection the fresh funding commission.